The Trump Tariff Equation Explained

What's behind the Trump Tariffs

RNfinity | 08-04-2025The economic world reacted strongly to Trump's sweeping Tariffs which aim to re-address the US trading deficits with key trading partners. In what was billed as reciprocal tariffs to counter trade barriers, unfair practices and corruption, a list of nations with their US tariffs and the proposed reciprocal tariffs was presented by President Trump. Each reciprocal tariff was one half of the quoted Tariffs on US goods or 10% which ever was higher. Whilst on the surface this may seem fair, the quoted tariffs on US goods were not in fact tariffs but proportional trade deficits with those countries. These arise due to a host of economic factors.

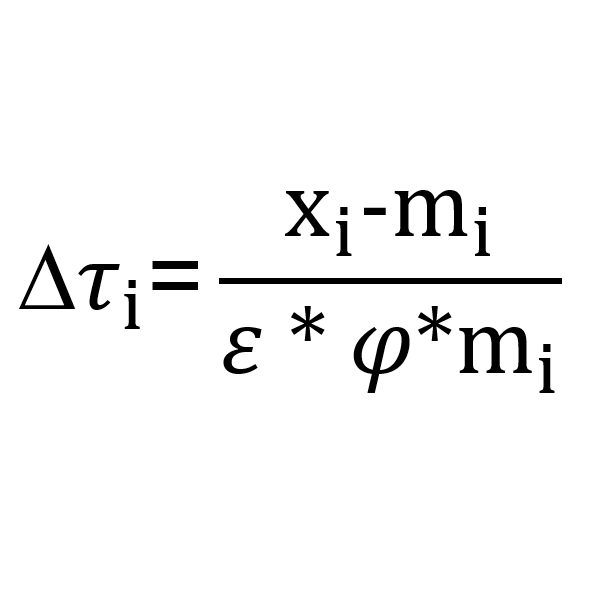

The US Government published the now famous equation above, which was used to calculate the tariffs that other nations applied to US goods. The equation calculates the value of US exports to a particular country (x) minus the imports (m), dividing by the imports (m). The other two Greek characters are modifiers, ε is the price elasticity of goods i.e. the proportion that demand goes down for a proportional prise rise. An elasticity of -2 indicates that if price increases by 10% then demand falls by 20%. φ is the proportion of the tariff that is passed on to to the consumer. The US Government quoted a value of 0.25 for φ and -4 for ε, effectively these two values cancel each other out as multiplied together they equal (-)1. Some commentators on CNN recently pointed out that the quoted value for φ of 0.25 isn't correct as it is usually close to 1 or all of the price increase being passed on to consumers, but this actually doesn't tell the whole story as a price elasticity of -4 is likely to be an exaggeration in the opposite direction as most goods typically have a price elasticity of -1 to -2. Bundling a whole variety of goods under a single price elasticity is clearly a simplification. The table below gives the typical price elasticity for common goods.

Essentially the above equation estimates what tariff would need to be applied to imported goods from another country to reduce the import from that country to match the exports from the US to that country. The unexplained division of the values by 2 infers a price elasticity closer to -2, or a conservative approach to a price elasticity of -1. Off course this is a controversial topic and we have no political leanings. The outcome of the policy is unknown; on the one hand increasing trade tariffs over a long period of time could lead to protectionism, trade barriers, increased costs, reduced choice and stifled innovation, but it could also lead to a negotiated reciprocal reduction of tariffs.

| Category | Examples | Typical Characteristics | Price Elasticity (PED) ε |

|---|---|---|---|

| Food Staples | Bread, milk, rice, eggs, flour, pasta, potatoes, cheese | Essential, frequent purchase, low unit price | –0.2 to –0.5 |

| Beverages | Bottled water, soft drinks, tea, coffee, fruit juice, energy drinks | Brand loyalty, some substitution, moderately price-sensitive | –0.8 to –1.2 |

| Personal Care | Shampoo, toothpaste, soap, deodorant, razors, facial cream | Routine use, habit-driven, brand stickiness | –0.3 to –0.7 |

| Cleaning Products | Detergents, surface cleaners, bleach, disinfectants, sponges | Essential for hygiene, often bought in bulk | –0.2 to –0.6 |

| Toiletries | Toilet paper, tissues, sanitary products, cotton swabs | Highly inelastic, essential daily use | –0.1 to –0.4 |

| Snacks & Confectionery | Chips, candy, chocolate bars, gum, cookies | Impulse-driven, brand-driven, elastic | –1.0 to –1.8 |

| Over-the-Counter Medicines | Painkillers, cold remedies, allergy medication, vitamins | Health-driven, necessity, but sometimes brand-substitutable | –0.2 to –0.6 |

| Cigarettes & Alcohol | Cigarettes, beer, spirits, wine, cigars | Addictive, taxed, price-insensitive in short term | –0.3 to –0.7 |

| Baby Products | Diapers, baby food, wipes, formula, baby lotion | Parental necessity, loyalty-driven | –0.2 to –0.4 |

| Pet Food | Dog food, cat food, birdseed, pet treats, pet supplements | Substitutable, essential for pet owners | –0.4 to –0.8 |

| Health & Wellness | Vitamins, protein supplements, fitness trackers | Health-focused, growing trend, moderate elasticity | –0.5 to –1.0 |

| Technology Accessories | Phone chargers, headphones, screen protectors, cases | Impulse purchases, influenced by trends, moderately elastic | –1.0 to –1.5 |

| Home Appliances | Vacuum cleaners, microwaves, refrigerators, coffee makers | Durability, often a one-time purchase, elastic | –1.0 to –2.0 |

| Clothing & Apparel | Jeans, t-shirts, dresses, shoes, jackets | Fashion-driven, seasonal, relatively elastic | –1.0 to –2.0 |

| Cars & Vehicles | Sedans, SUVs, trucks, electric vehicles, motorcycles | High price, durable, infrequent purchase, significant substitution | –1.0 to –2.5 |

| Computers & Laptops | Desktops, laptops, tablets, gaming PCs, accessories | High price, performance-driven, rapid technological obsolescence | –1.5 to –2.5 |

| Smartphones & Mobile Devices | Smartphones, feature phones, smartwatches, tablets | High brand loyalty, frequent upgrades, highly elastic | –1.5 to –3.0 |

| Luxury Goods | Designer handbags, luxury watches, jewelry, high-end cars | Exclusivity, high-income customers, inelastic in short term | –0.2 to –0.5 |

| Furniture & Home Decor | Sofas, dining tables, lamps, curtains, mattresses | Durable, infrequent purchase, price-sensitive | –1.0 to –2.0 |

| Sports Equipment | Bicycles, gym equipment, sporting goods (e.g., tennis rackets, golf clubs) | Seasonal, sport-specific, elastic | –0.8 to –1.5 |

| Elasticity Value | Interpretation |

|---|---|

| < –1 | Elastic (very responsive) |

| = –1 | Unit elastic |

| > –1 but < 0 | Inelastic (less responsive) |

| = 0 | Perfectly inelastic |